Legal Updates

From Reform to Refinement: Ethiopia to Update the Directive on Foreign Participation in Restricted Export, Import, Wholesale and Retail Trade

The Ethiopian Investment Board Directive to Regulate Foreign Investors’ Participation in Restricted Export, Import, Wholesale and Retail Trade Investments No. 1082/2025 In March 2024, the Ethiopian Investment Board issued Directive No. 1001/2024,...

A Landmark Development for Ethiopia’s Real Estate Sector

Sisay Habte and Michael Mengistu The House of Peoples Representatives has passed the long-awaited Real Estate Development and Real Property Marketing and Valuation Proclamation as Proclamation No. 1357/2024. The Proclamation aims to establish a...

Ethiopia’s Personal Data Protection Proclamation Enters in to Force

Bezawit Yirga and Benyam Taffese Ethiopia has launched its journey towards strengthening data protection with the recent enactment of the long-awaited Proclamation on Personal Data Protection (Proclamation No. 1321 /2024), published in the official...

Fee Rates Payable for Services Provided by the Ethiopian Immigration and Nationality Service, under Council of Ministers Regulation No. 550/2024

Benyam Tafesse and Bezawit Yirga On July 7, 2024, the Council of Ministers issued a new regulation, the Fee Rates Payable for Services provided by the Immigration and Nationality Service, under Council of Ministers Regulation No. 550/2024 (the...

Navigating the Green Directive: Frequently Asked Questions

Introduction The recent directive from the National Bank of Ethiopia signifies a major shift towards adopting a market-based exchange rate system, reflecting a broader trend observed in developing countries. The National Bank of Ethiopia (NBE) has...

Carbon Trading under the Forest Development Protection and Utilization Regulation No. 544/2024

Carbon Trading under the Forest Development Protection and Utilization Regulation No. 544/2024 The Forest Development Protection and Utilization Regulation No. 544/2024 (hereafter the “Regulation”) became effective on April 4, 2024. The Council of...

Legal Update on the New Excise Stamp Management Directive No. 1004/2024: Key Regulations and Requirements

Legal Update on the New Excise Stamp Management Directive No. 1004/2024: Key Regulations and Requirements The Ministry of Finance issued an Excise Stamp Management Directive No. 1004/2024 (hereafter the “Directive”) in June 2024, with the following...

A Revival of an Old Ethiopian Transfer Pricing Directive : How does the Renumbered TP Directive affect Taxpayers?

Dr. Taddese Lencho The dormant Transfer Pricing (TP) Directive of 2015 was recently renumbered and reissued by the Ethiopian Ministry of Finance as “Directive to Provide Rules on Transfer Pricing Directive No. 981/2024”. The renaming has more to do...

Foreign Investment Inflows: New Era for Wholesale, Retail, Import and Export Sectors

Dr. Taddese Lencho and Sisay Habte Wholesale, retail, import and export businesses have for a long time been the exclusive preserves of Ethiopian nationals in successive investment laws. The current investment regulation, Regulation No. 474/2020, has...

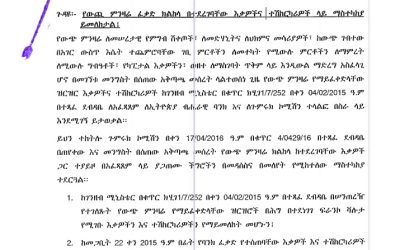

Ethiopian Ministry of Finance Issues Circular Amending Foreign Currency Approvals

Tibebe Zewdu The Ethiopian Ministry of Finance (MoF) has recently issued a Circular on 07 March 2024 (28 Yekatit 2016 E.C) amending the previous Circular it issued back on 14 October 2022 (04 Tikemt 2015 E.C) to restrict foreign currency approvals to...

A Revival of an Old Ethiopian Transfer Pricing Directive: How Does The Renumbered TP Directive Affect Taxpayers?

Dr. Taddese Lencho (PhD) The dormant Transfer Pricing (TP) Directive of 2015 was recently renumbered and reissued by the Ethiopian Ministry of Finance as “Directive to Provide Rules on Transfer Pricing Directive No. 981/2024”. The renaming has more...

ACSO’s New Directive on Registering and Administration of Foreign Charitable Organizations

Sisay Habte The Authority for Civil Society Organizations (ACSO) Directive No. 986/2024 is one of the more recent directives issued by the Authority for Civil Society Organizations (ACSO). The Directive provides for the requirements for the...

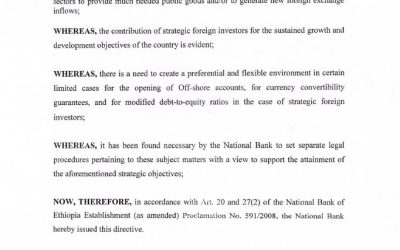

Ethiopia allows Offshore Accounts for Strategic FDI investments

Dr. Taddese Lencho In a significant and bold move to attract strategic investors into Ethiopia and generate new foreign currency inflows, the National Bank of Ethiopia (NBE) has issued Off-shore Account Opening and Operations for strategic Foreign...

Cassation Bench of the Federal Supreme Court Ruling on Valuation of Imported Goods

Tibebe Zewdu The Federal Courts Proclamation No. 1234/2020 provides that “Interpretation of law rendered by the Cassation Division of the Federal Supreme Court with not less than five judges shall be binding from the date the decision is rendered.”...

Doing business via non-profits: a look at the newly enacted directive on income generating activities

Sisay Habte The Civil Society Proclamation, Proclamation no. 1113/2019 gives Civil Society Organizations (hereinafter “CSO/CSOs”) the right to engage in businesses and investments to raise funds and fulfill their objectives. The Proclamation provided...

What is “New” about the New Investment [Tax] Incentive Regulations?

A new Investment Incentive Regulation (No 517/2022) was approved by the Council of Ministers on 21 May 2022 and published on the Negarit Gazetta on July 12, 2022 (effective date). The new Investment Incentive Regulation repeals and replaces investment tax incentive regulations in place since 2012. It is important to qualify this regulation as a “tax incentive” regulation as the non-tax incentives are provided for in other pieces of legislation.

The new Investment Incentive Regulation maintains the characteristic features of the 2012 Incentive Regulation, namely the itemization in a schedule of specific investment areas….

Stamp Duties or Stamps of Evidence?

The new Books of Accounts Directive (“Directive No. 176/2014,” in Amharic) appears to be a backhanded attempt to revive and enforce the little known Stamp duty law, issued back in 1998, particularly the stamp duties payable on employment contracts, and all contracts, agreements and memoranda. It conditions burden of proof to obtain tax benefits (e.g., tax deductions) upon payment of the double amount of stamp duties for admission of stamp-able documents for other tax purposes.

Here are a few problems with this form of backhanded enforcement.